Global Voice

Global Voice has entered into an MOU with Viatel Holdings (Bermuda) Limited, allowing for GV to purchase the inter-city fibre assets of Viatel for 25m euros. This agreement has made GV the operator of one of the largest infrastructure assets in Europe.

Who is Viatel?

Viatel owns a long-haul intercity fibre network across the UK, Holland, Belgium, Germany, Switzerland and France. Although Viatel has 6,800 km of network linking towns and cities in these six countries, it has a minimal metropolitan network within each city. In contrast, GVG has a dense network of metropolitan fibre network in the cities it operates in. GVG has an average of six ducts in each pipe in each city, in contrast to Viatel’s two ducts running inter-city. GVG’s duct network in its 14 cities only amounts to 1,330 km.

Reason for Viatel to sell

Viatel’s intercity assets were built by a US company in 1999-2001 during the dot-com boom days. These assets were sold to a private equity fund (run by Morgan Stanley) when the US company went into Chapter 11. There is limited development for the last few years, as it does not have connections. The investment fund sees the value of GV’s metropolitan network and is willing to work along with GV.

Issue Of Convertible Bonds Due 2011

€35 million in principal amount of the convertible bonds due 2011 was issued, and with an additional subscription up to €5 million, with an initial conversion price of $0.20 per share. This will enable GV to have cash for the Viatel ‘s deal, and an excess cash for working capital or other acquisition.

Emerge of New shareholders

Peter Cundill & Associates (Bermuda) Ltd. - Mackenzie Cundill Recovery Fund has become a substantial shareholder with 200 million shares or 8.35%. JP Morgan Chase and Co and its affiliates also join in the team with 145 million shares or 6.08%.

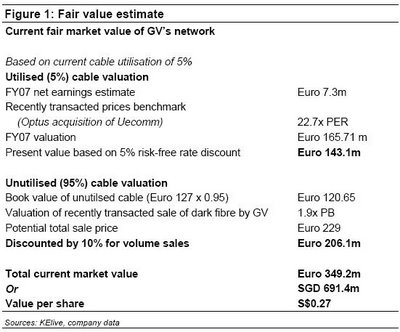

According to Kelive.com, with a mere 5% utilization of the cable, the cable is underutilized. GV being a young company has set its objective to increase its client base first. So for the near future, GV will expand its cable utilization.

The cable was purchased at €135 million euro which is at a huge discount of its building price of €600 million. This is a great asset backing for GV.

Business Analysis

High Barrier of entry

High costs are incurred for the construction of the network infrastructure, which also must be extensive to cover city area. This will deter any potential entry of new player in this market.

Next, this whole project of laying the infrastructure will take years to complete. During this period, the player will not register any revenue income or any other form of income; this will keep a boundary for potential player to enter this industry.

Bargaining Power

As GV has acquired its assets at a relatively low cost as compared to its peers, therefore GV can afford to offer services at a competitive price over its peers.

Technology Limits

It is almost not possible to find a cheaper and more efficient substitute for fiber optics cable. As different materials exhibit different character and will affect the bandwidth, so it is not viable to replace with other substitute at the moment.

Net Cash and Low Gearing

GV through the reverse takeover of Horizon Education, has bring the company to a net cash and low gearing position. This will enable GV to achieve financial backing for any further acquisition.

From Figure 1, ( Source from Kelive ), the estimated fair value is $0.27 without factoring in Viatel’s deal and other future growth. Also the utilization of the cable is expected to rise, and the management of GV has targeted to break even in FY 2006.

Potential Takeover target

With a net cash and low gearing, and un-utilized cable, its peer might be interested to buy over GV so as to monopolies the industry or remove any upcoming competitor.

Bearing all these factors in mind, I will consider GV to be a safe bet for long term investment.

Comments